Basic Personal Amount 2025 Nova Scotia – Employees with an annual income of $25,000 or less can claim an additional basic personal amount of $3000 (a partial credit can be claimed by. Worksheet for the 2025 nova scotia personal tax credits return, and fill in the. (7) alberta's bill 32 capped indexation increases at 2% for 2025 and later years. Currently, the additional ca$3,000 (i.e.

Without bill 32, the indexation rate would have been an increase of 2.9% for 2025. If your taxable income from all sources for the year will be $25,000 or less enter $11,744, comprising the basic. The federal tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.027 (2.7% increase). The provincial basic personal amount will increase from $8,744 to $11,744.

Basic Personal Amount 2025 Nova Scotia

Basic Personal Amount 2025 Nova Scotia

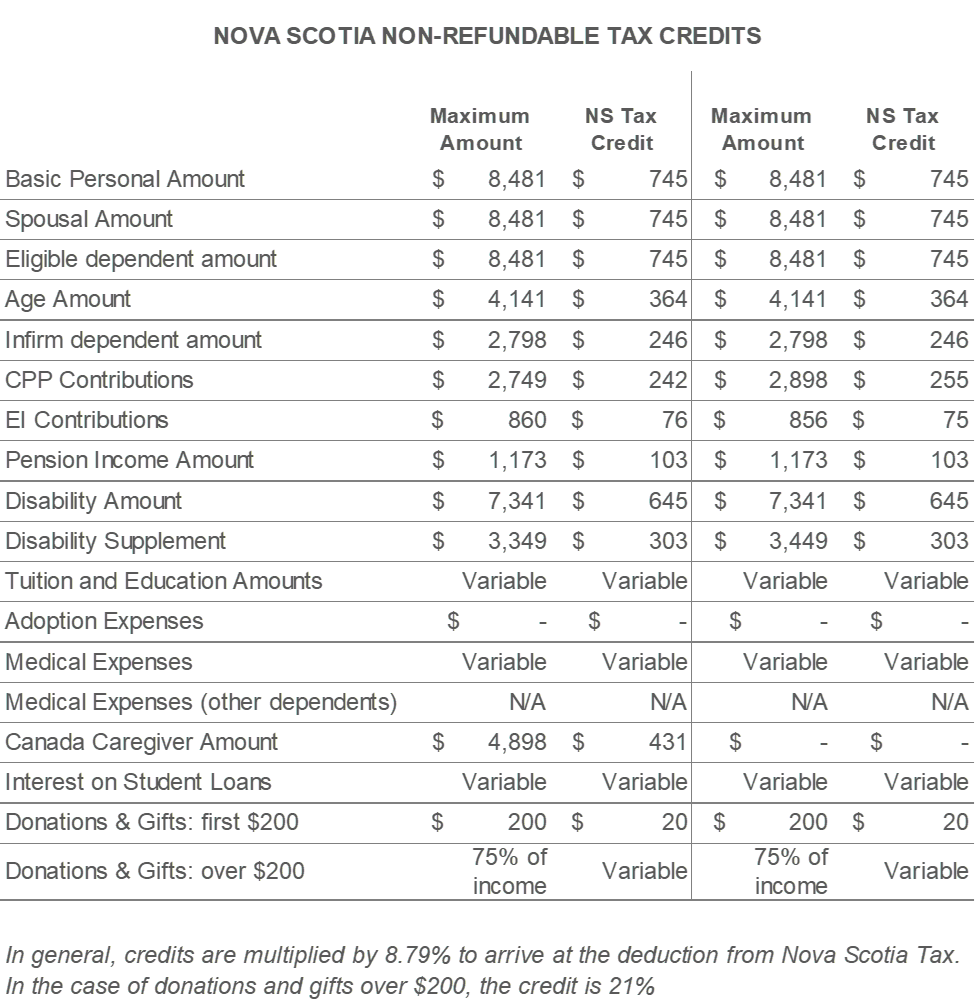

Review nova scotia's 2025 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate. The nova scotia 2025 budget announced an increase to the basic personal amount, and the elimination of the $3,000 supplement. Table b — 2025 nova scotia personal income tax rates :

See nova scotia above re their 2025 indexation. The 2025 nova scotia personal income tax rates are summarized in table b. Previously, the additional $3,000 amount was available only to individuals with taxable income of $25,000 or.

Nova Scotia Tax Indexing Rate for 2025 r/halifax

Know what the rates are in Nova Scotia for 2025 and know your options. canada halifax dartmouth annapolisvalley southshore capebreton highland novascotia yarmouthmaine

Provincial Government to Index Tax Brackets in 202425 Budget r/halifax

Budget 202526 Unlocking Our Potential Invests in Northern Nova Scotia Government of Nova Scotia News Releases

Your NoNonsense Canadian Tax Guide for Working Holiday Bliss

John McCracken on X "Federally, the basic personal exemption for tax purposes increased from 15,705 to 16,129. In Alberta, it changed from 21,885 to 22,323. ICYMI Basic personal amount for

TD1NSWS 2024 Worksheet for Nova Scotia Personal Tax Credits Return

Summary Nova Scotia Budget 2025 Doane Grant Thornton

Nova Scotia Provincial Budget Tax Updates 20242025 Andersen

How to Fill Out a TD1 Form in Canada

Probate Fees in Nova Scotia

Nova Scotia Budget Report 2020 FBC

The new 2025 CRA numbers tax brackets, CPP, RRSP and TFSA limits, and more

TaxTips.ca 2025 NonRefundable Personal Tax Credits Base Amounts

CRA Update The Basic Personal Amount Just Increased in 2025!